Discounted future cash flow calculator

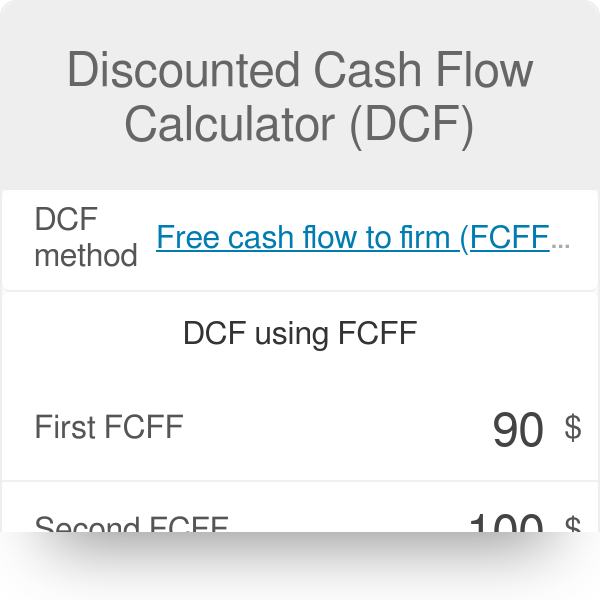

Our online discounted cash flow calculator helps you calculate the discounted present value aka. To do this we need to split the future cash flows into two portions.

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

The fair value of a.

. This is the value of all of your future cash flows discounted in todays dollars at your Weighted Average Cost of Capital WACC. A project or investment is profitable if its DCF is higher than the initial cost. Conversely if you wanted to know how much you would need to deposit today for your investment to grow to 110 in 1 year you would discount the future value by dividing it by 1 plus the rate.

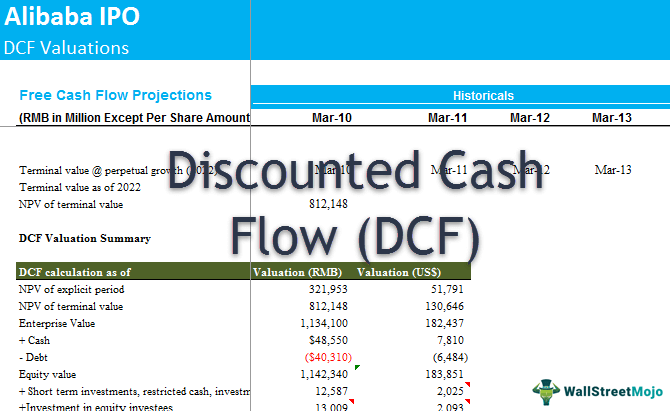

DCF CF1 CF2. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. To calculate the enterprise value the present value of cash flows for the years from now till the end of the forecast period are divided by the discount rate and then added.

How Do You Calculate Discounted Cash Flow From Npv. CFn 1r 1 1r 2 1r n The discounted cash flow formula uses a cash flow forecast for future years discounted back to. As long as you know what the expected future cash flows are.

Now that we have growth and discount rates we can calculate all future cash flows. Ad Forecast your future cash position and regain your control on your business finances. Intrinsic value of future cash flows for a business stock investment house purchase.

Business valuation is typically based on three major methods. Build Your Future With a Firm that has 85 Years of Investment Experience. Our Resources Can Help You Decide Between Taxable Vs.

Ad EY Corporate Finance Consultants Help All Types of Businesses with Key Financial Issues. Download our toolkit to learn how to forecast cash flow statements even in uncertain times. The discounted cash flow DCF model is probably the most versatile technique in the world of valuation.

We start with the formula for PV of a future value FV single lump sum at time n and interest rate i P V F V 1 i n Substituting cash flow for time period n CFn for FV interest rate for the. Initial FCF Rs Cr Take 3 Years average. Business Valuation - Discounted Cash Flow Calculator.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. We can now calculate the PV starting. The income approach the asset approach and the market comparable.

Expected annual growth This is the rate you expect your. EY Has the People Analytics and Tools to Help You Better Allocate Capital. Build Your Future With a Firm that has 85 Years of Investment Experience.

Since money in the future is worth less than money today you reduce the present value of each of these cash flows by your 10 discount rate. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. Discounted Cash-flow Model is a quantitative method that calculates a companys stock price based on the sum of all future free cash flow earned from that company at a discount rate.

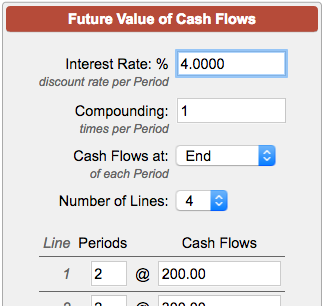

With compounding m times per period we arrive at i n and n by setting r as the periodic rate and t as the period number to calculate i n rm and n mt. Discounted cash flow DCF evaluates investment by discounting the estimated future cash flows. As an alternative to the more abbreviated income capitalization approach this methodology is more relevant where future operating conditions and cash flows are variable or not projected.

Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets. Specifically the first years cash. However either way its always based on the following discounted cash.

The discounted cash flow DCF formula is. For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks. Net the sum of all positive and negative cash flows Present value discounted back to the time of the investment DCF Formula in Excel MS Excel has two formulas that can.

Cash flows for the. NPV discount rate cash flow series NPV discount rate cash flow series NPV discount rate A discount rate of 33 should be. The discounted cash flow calculation can be straightforward or complicated depending on the elements it contains.

The discounted cash flow calculator calculates the weighted average cost of capital WACC taking into account the financial leverage of the business the cost of equity. To calculate what a certain amount of money is worth in the future you have to discount it or account for the fact that you lost the chance to invest it and earn money from it. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

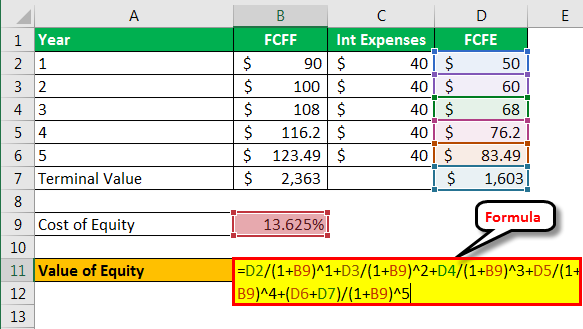

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

How To Use Discounted Cash Flow Time Value Of Money Concepts

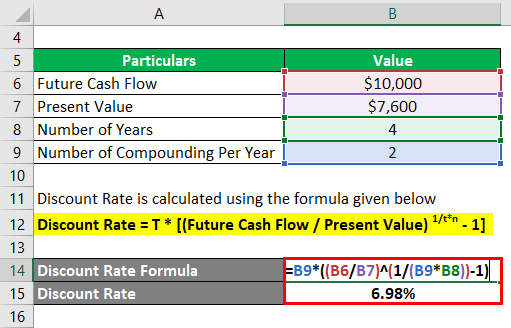

Discount Rate Formula How To Calculate Discount Rate With Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

Discounted Cash Flow Model Formula Example Interpretation Efm

How To Calculate Discounted Cash Flow For Your Small Business

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Present Value Formula Calculator Examples With Excel Template

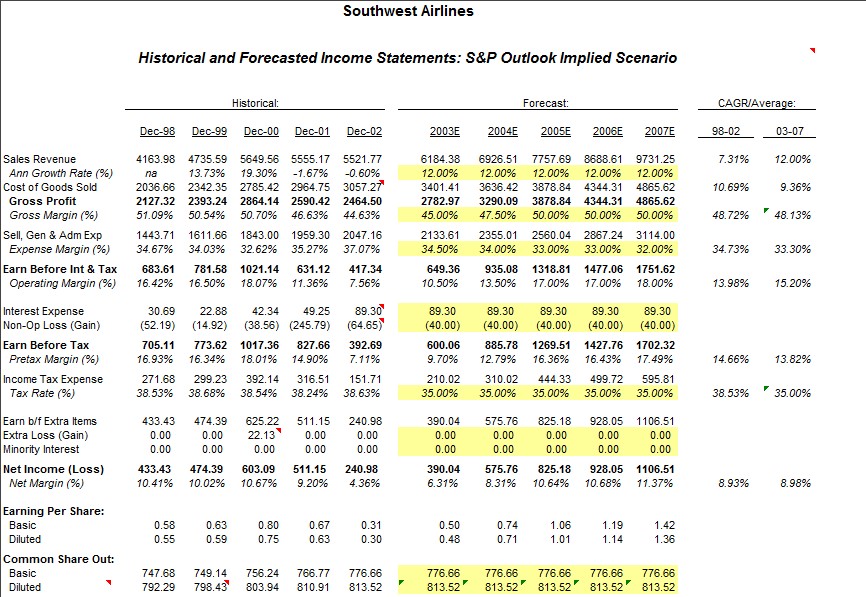

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich

Future Value Of Cash Flows Calculator

Discounted Cash Flow Calculator Dcf